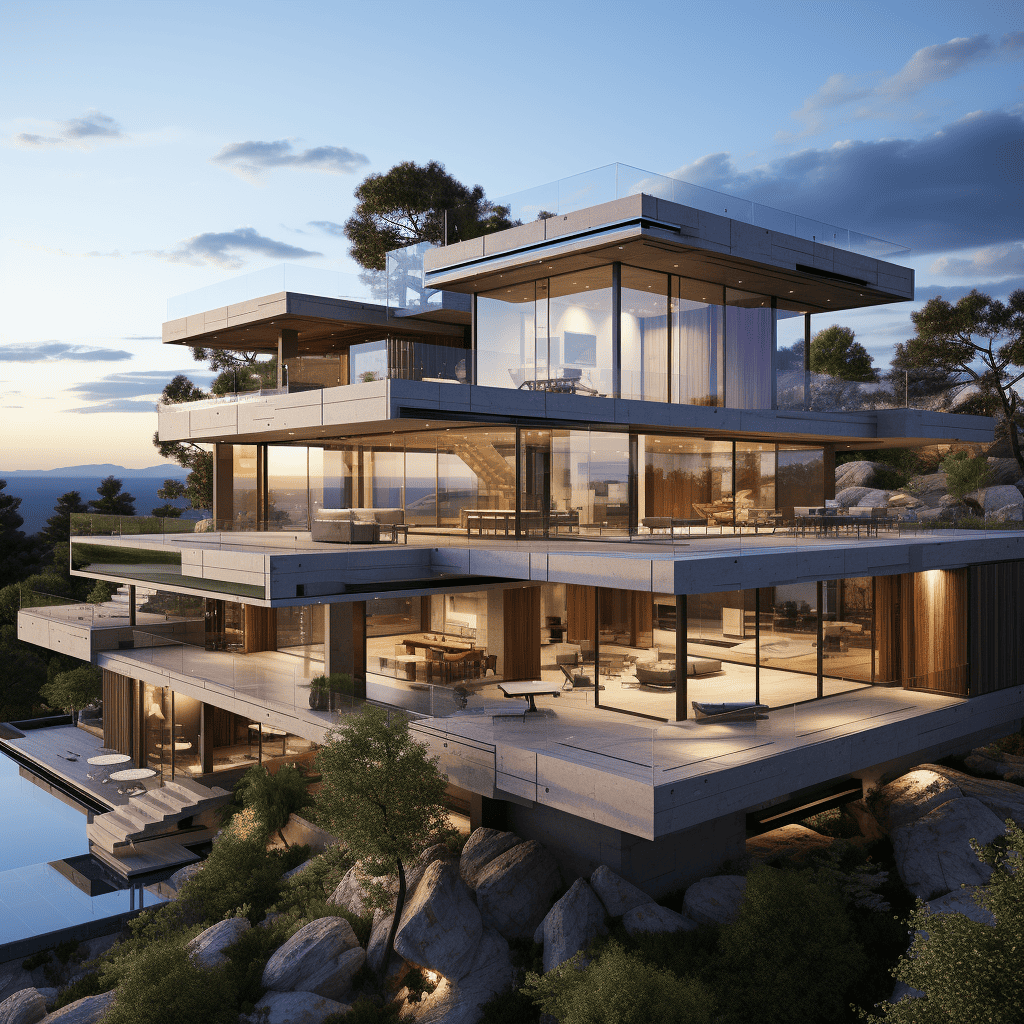

If you’re passionate about real estate investments and want to explore the world of commercial properties, starting a blog focused on investing in commercial real estate can be a valuable platform to share your knowledge and insights. Here are some informative blog post ideas to guide aspiring commercial real estate investors:

- Understanding the Basics: Provide an overview of commercial real estate investment, including the different types of properties, such as office buildings, retail spaces, industrial properties, and more.

- Analyzing Market Trends: Discuss current market trends in commercial real estate and how they impact investment decisions.

- Assessing Risk and Returns: Explain the risk factors involved in commercial real estate investment and how to evaluate potential returns.

- Location Matters: Highlight the importance of location in commercial real estate and what investors should consider when choosing properties.

- Financing Options: Offer insights into various financing options available for commercial real estate investments, such as traditional loans, private funding, and partnerships.

- Due Diligence: Guide investors on conducting thorough due diligence before making a purchase, including property inspections, financial analysis, and legal considerations.

- Negotiating Deals: Share effective negotiation strategies for getting the best possible deal on commercial properties.

- Lease Agreements: Explain the key components of commercial lease agreements and how they can impact an investor’s bottom line.

- Investment Strategies: Discuss different investment strategies in commercial real estate, such as buy and hold, value-add, and redevelopment.

- Property Management: Explore the ins and outs of managing commercial properties and the importance of effective property management.

- Calculating Cap Rates: Help investors understand how to calculate cap rates and use them to assess the potential profitability of a property.

- Tax Implications: Discuss the tax implications of commercial real estate investment and how investors can maximize tax benefits.

- Navigating Zoning Laws: Offer insights into zoning regulations and how they can affect the use and development of commercial properties.

- Exit Strategies: Provide guidance on developing exit strategies for commercial real estate investments, including selling, refinancing, or 1031 exchanges.

- Real Estate Investment Trusts (REITs): Explain what REITs are and how they can be a viable option for investors looking to diversify their portfolios.

- Financing Commercial Real Estate: Discuss the financing options available for commercial real estate investments, including commercial mortgages and bridge loans.

- Risk Management: Offer advice on managing risks in commercial real estate investing, including how to protect against market downturns and tenant vacancies.

- Finding Off-Market Deals: Share strategies for finding off-market commercial real estate opportunities and the benefits of such deals.

- Working with Professionals: Highlight the importance of working with a team of professionals, including real estate agents, brokers, attorneys, and property managers.

- Case Studies: Present real-life case studies of successful commercial real estate investments, showcasing different strategies and outcomes.

By providing valuable information and insights, your blog can become a trusted resource for those interested in exploring the exciting world of commercial real estate investment.