Blogging about the Basics of Commercial Real Estate Investment: If you’re interested in delving into the world of commercial real estate investing, starting a blog focused on the fundamentals can be a great way to educate and empower aspiring investors. Here are some informative blog post ideas to guide beginners in understanding the basics of commercial real estate investment:

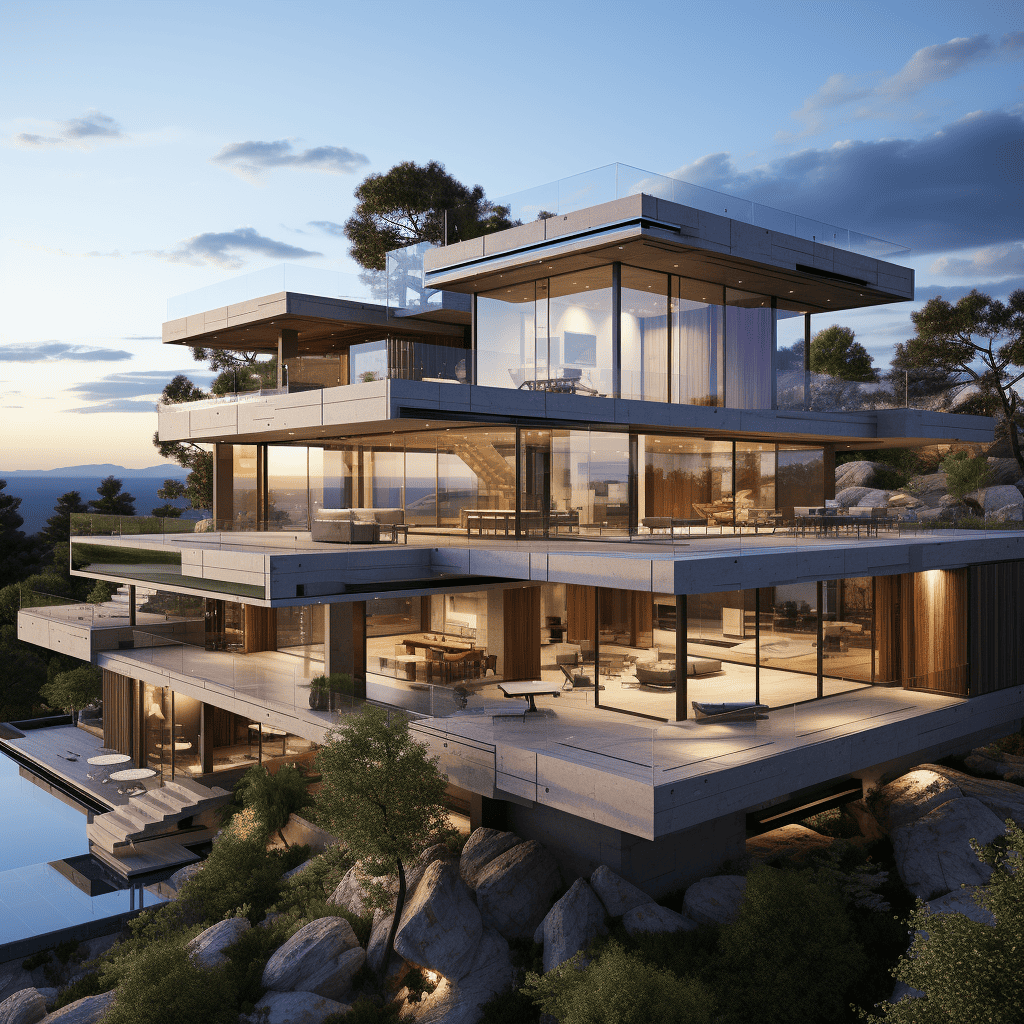

- Introduction to Commercial Real Estate: Provide an overview of what commercial real estate is and how it differs from residential real estate.

- Types of Commercial Properties: Explain the different types of commercial properties, such as office buildings, retail centers, industrial spaces, and multifamily complexes.

- Benefits of Commercial Real Estate Investment: Highlight the advantages of investing in commercial properties, including potential high returns and long-term appreciation.

- Key Investment Metrics: Introduce important metrics like capitalization rate (cap rate), cash-on-cash return, and net operating income (NOI) to assess the profitability of a commercial property.

- Understanding Market Analysis: Guide readers on conducting market analysis to identify promising locations for commercial real estate investment.

- Financing Options for Commercial Properties: Discuss various financing methods, including traditional loans, commercial mortgages, and private funding.

- Due Diligence for Commercial Real Estate: Explain the essential steps in due diligence, such as property inspections, financial analysis, and tenant assessments.

- Lease Types and Terms: Educate readers on different commercial lease structures, like triple net (NNN) leases and gross leases, and their implications.

- Evaluating Potential Tenants: Offer insights into tenant screening and selection to ensure a stable income stream for the investment.

- Risks and Challenges: Address the risks associated with commercial real estate investment, such as tenant vacancies, economic fluctuations, and property maintenance.

- Legal Considerations: Discuss legal aspects, like zoning regulations, property tax implications, and lease contract negotiations.

- Investment Strategies: Present various investment strategies, including value-add opportunities, long-term holds, and redevelopment projects.

- Diversification and Portfolio Management: Explain the importance of diversifying a commercial real estate portfolio and how to manage multiple properties effectively.

- Exit Strategies: Guide readers on developing exit plans, including selling, refinancing, or conducting 1031 exchanges.

- Working with Professionals: Emphasize the value of collaborating with experienced real estate agents, property managers, and attorneys.

- Real Estate Investment Trusts (REITs): Introduce REITs as a way for investors to access commercial real estate opportunities without direct ownership.

- Calculating Investment Returns: Offer step-by-step guides on calculating cap rates, cash flow, and return on investment (ROI).

- Common Mistakes to Avoid: Share common pitfalls that new investors should watch out for in commercial real estate.

- Case Studies: Provide real-life examples of successful and unsuccessful commercial real estate deals to illustrate key principles.

- Resources for Continued Learning: Curate a list of valuable books, courses, websites, and industry organizations that can help readers deepen their understanding of commercial real estate investment.

By sharing foundational knowledge and practical advice, your blog can become a go-to resource for individuals eager to embark on their journey in commercial real estate investing.